Australian Real Estate Agencies Compliance solutions

Bilston Group leverages RAC Pro to streamline compliance across Australia’s real estate sector.

From 1 July 2026, Australian real estate agents must implement tailored AML/CTF1 compliance programs, including risk assessments, customer due diligence, staff training, and reporting procedures. These measures align the sector with global standards and strengthen Australia’s financial integrity. Our platform RAC Pro can provide these services across the Real Estate Sector, particularly for Real Estate Agencies with multiple franchises or owned agencies.

THE RAC PRO ADVANTAGE

Multiple agencies, complete vision and lower risk

Using RAC Pro’s federation structure, a real estate agent can maintain a single, global vision across all its agencies and their policies and procedures. This means the compliance function is centralised and manageable, even if regulator scrutiny is mandated

EFFICIENT WORKFLOWS

Integrating RAC Pro builds wealth in training

Training all staff in RAC Pro, binds all staff to the company’s goals of monitoring client behaviour that could cause regulatory pain for the business in the long run.

KEY FEATURES

Extra benefits for your agency

Automated Risk Assessment

Conduct an automated risk analysis based on your assessment of the business

Ongoing support

Bilston Group offers updates, guidance, and responsive help whenever you need it.

Detailed Registers

Complete vision over training and reports generated

Complete Record Keeping

Transparent and relevant files can be generated at any time for record keeping and audit purposes

Integrated

Can be integrated with other systems for independent identity checking and verification

Consolidated

All-in-one solution platform available to franchiser/franchisees/agencies under one reporting entity

what AGENTS say

“To have everything on one platform in conducting an AML/CTF program lowers the risk in managing multiple sites and franchisees.”

Case Studies from the real estate sector

Starting 1 July 2026, Australian real estate agents will be required to comply with stringent AML/CTF1 regulations, including enrolling with AUSTRAC, implementing a tailored compliance program, conducting thorough customer due diligence, and reporting suspicious activities. These measures aim to align the real estate sector with international standards and enhance the integrity of Australia’s financial system.

How RAC Pro can provide an efficient technology solution for Real Estate Agents implementing their AML/CTF programs

Starting 1 July 2026, Australian real estate agents will be…

FREQUENTLY ASKED QUESTIONS

Making Compliance Simple for Real Estate Agency Professionals

What is AML?

AML stands for Anti-Money Laundering. These laws and practices are designed to stop criminals from disguising illegally obtained money as legitimate income.

For the Australian real estate sector, AML compliance is critical because property transactions are high-value and can be exploited for money laundering or terrorism financing. By following AML rules, agents and businesses protect the integrity of the market, avoid legal and financial penalties, and build trust with clients and investors while supporting Australia’s international obligations.

What is CTF?

CTF stands for Counter‑Terrorism Financing. These laws and measures are designed to prevent funds from being directed toward terrorist activities, whether through direct transfers or hidden within legitimate business transactions.

In the Australian real estate sector, CTF compliance is vital because property deals can be misused to channel or disguise money for terrorism. By following CTF requirements, agents and businesses help protect national security, maintain the integrity of the property market, and demonstrate transparency to clients and regulators. This strengthens trust in the industry and ensures Australia meets its international security obligations.

Why do real estate agencies need a risk‑based AML/CTF program?

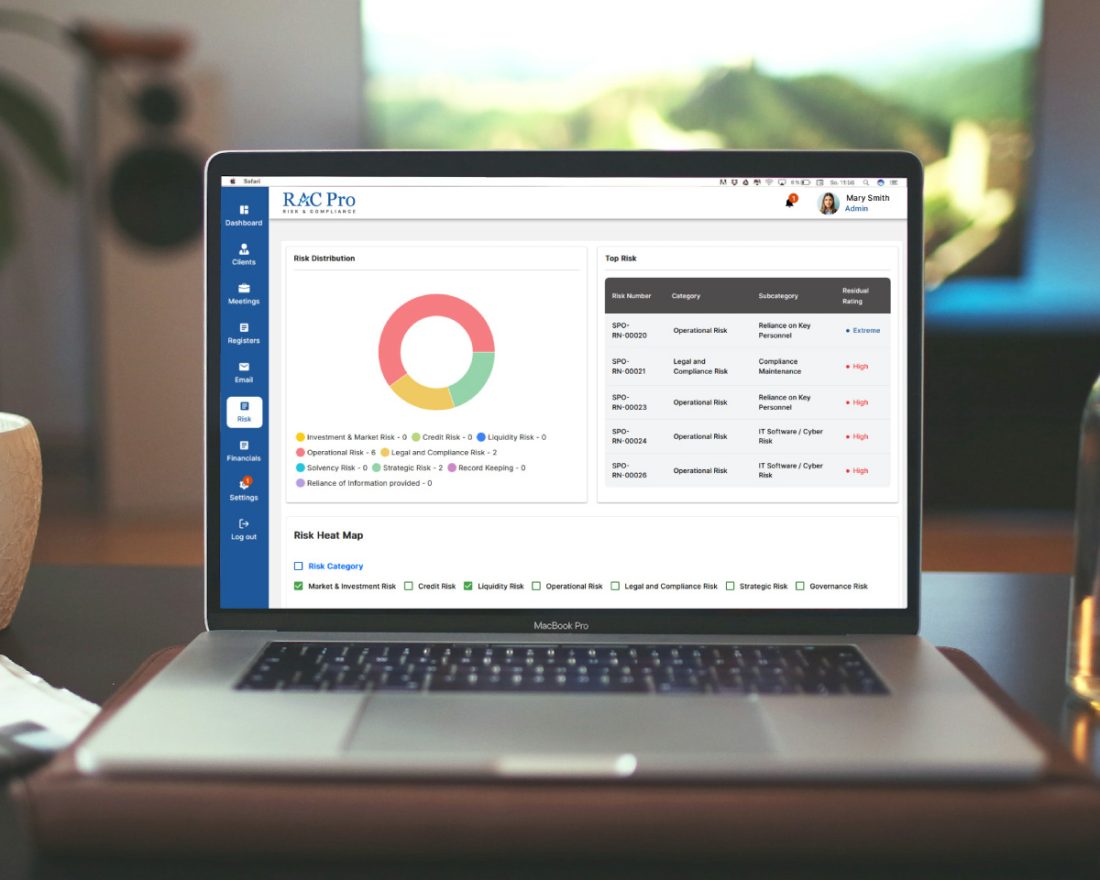

From July 2026, agencies must tailor their compliance program to the specific risks they face. A generic, one‑size‑fits‑all approach won’t meet AUSTRAC’s expectations. RAC Pro’s Risk Module helps agencies identify inherent and residual risks, apply controls, and generate clear reports and heat maps—making risk management structured, transparent, and audit‑ready.

How can RAC Pro help appoint and manage an AML/CTF Compliance Officer?

Every agency must designate a compliance officer to oversee AML/CTF obligations. RAC Pro makes this simple by allowing agencies to assign roles through Role and Contact Checklists, attach responsibilities, and track accountability. This ensures leadership is centralised and compliance oversight is visible across franchises or multiple offices.

What tools does RAC Pro provide for customer due diligence (CDD)?

Agencies must verify client identities and assess risk before providing services. RAC Pro’s Entity Onboarding feature records detailed client information, while sensitive attachments can be restricted to authorised staff only. This creates a secure, auditable process for CDD that reduces manual errors and strengthens compliance.

How does RAC Pro support ongoing training and reporting?

Staff training is a legal requirement under AML/CTF regulations. RAC Pro’s Training Module schedules and tracks employee training, automatically updating the Training Register. Combined with the Registers and Policy Library modules, agencies can monitor suspicious transactions, record breaches, and produce reports in PDF or CSV formats—ensuring they meet AUSTRAC’s reporting and review obligations.

Get in contact

Talk to us today about how Bilston Group can improve compliance in your agency.

(1) AML/CTF – Anti-money laundering and counter terrorism financing